Although, each taxpayers situation is unique here is a list of forms that you may receive at tax time. Many documents should come to you by the end of January, but some of the broker and investment statements are not required to be sent out until mid-March. If you did not receive something that you should have, please contact your employer, financial institution, or university.

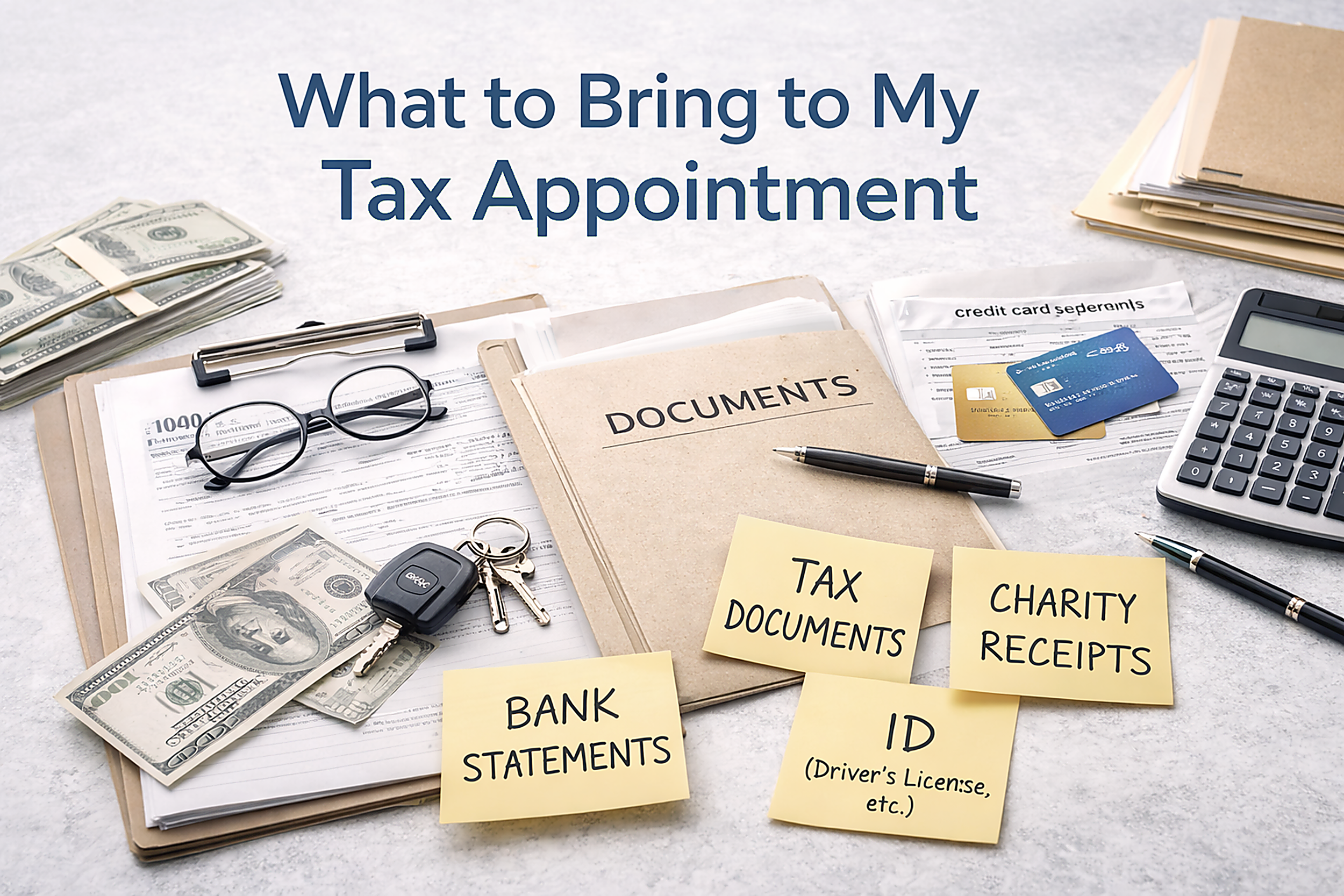

What should I bring to my tax appointment?

-

Driver’s license

Social security numbers and birthdays for all family members listed on tax return

IRS Theft Protection PIN

Bank account and routing number of your checking account (for direct deposit or payment)

Local tax forms

If a person on the tax return passed away, the death certificate is required

-

W2s

1099-SSA (white and pink form from Social Security)

1099-R (from retirement accounts)

1099-G (unemployment compensation)

1099-MISC

1099-NEC (non-employee compensation)

1099-INT (from savings and/or investment accounts)

1099-DIV (from investment accounts)

1099-B (from brokerage accounts)

1099-S (from the sale of property)

1099-C (from the discharge of debt)

Any K-1s for businesses of which you have ownership

If you rent property, please bring totals of profits and expenses broken out by property.

W-2G (any gambling winnings and losses)

1099-DA- Digital Assets/ Cryptocurrency transactions

Alimony received (if your divorce is dated before December 31, 2018)

-

1099-NEC

1099-MISC

1099-K

Total of all business income and expense

Documentation for home office expense; including square footage of area exclusively used for business and square footage of home

Records of assets to be depreciated

Miles travels for business by date

Premiums paid for self-employed health insurance

-

1098-T (from higher education expenses)

1098-E (student loan interest paid)

Child/Dependent Care Expenses (including EIN for the center)

Adoption expenses in the year of adoption

IRA contribution amounts

529 Plan contribution amounts

Health Savings Account contribution and distribution amounts

Unreimbursed employee expenses, i.e., uniforms, union dues, license fees, home office expenses, etc.

Cost of energy efficient improvements made to your residence

Electric vehicles (date purchased, VIN, year, make, model, and battery k/w capacity)

1095-A (Health insurance through the marketplace; 1095-B and 1095-C are not necessary)

-

Majority of people currently take the standard deduction which is $15,750 per individual. If the following items are higher than the standard deduction, then you might be able to itemize. We will need the following information if you are able to itemize:

Property tax receipts

Charitable Donations

Medical expenses

Nursing home expenses

Premiums paid for long-term care insurance

Form 1098 showing your mortgage interest, insurance premiums, and points

Gambling losses

-

Amounts and dates of any estimated tax payments

Prior-year refund applied to current year

Any amount paid with an extension to file

Foreign bank account information: location, name of bank, account number, peak value of account during the year

Prior- year tax return if you are a new client